Britain to raise contactless payment limit to 100 stg on Oct. 15 By Reuters

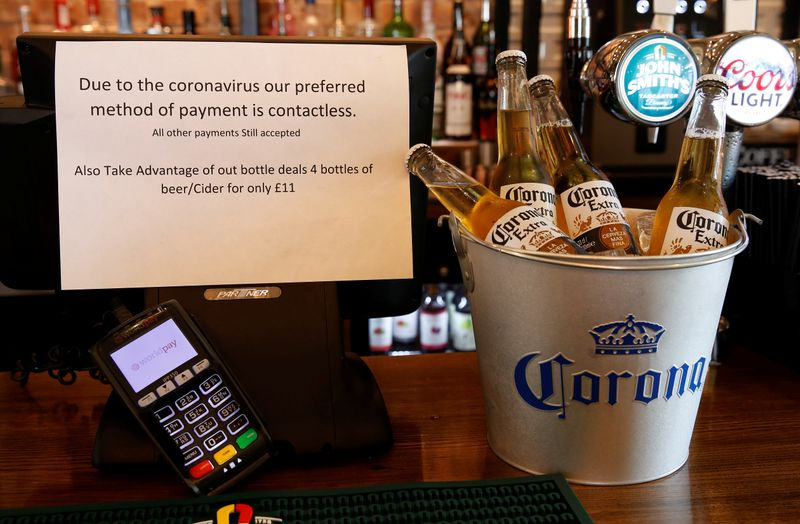

LONDON (Reuters) -Banks will start rolling out the new 100 pound ($137) spending limit for contactless payments from Oct. 15, Britain's banking industry body UK Finance said on Friday. Contactless payments surged during the pandemic, with some shops refusing to take cash to help prevent the spread of COVID-19. "Given the number of terminals which will need to be updated to accept the new limit, it will take some time to be introduced across all retailers," UK Finance said in a statement. Contactless payments accounted for 49% of all credit card and 65% of all debit...

Continue reading